Enrolling Your Fields

Enrolling Your Fields

Uploading Your Documents

Step-by-Step Instructions for Enrolling Your Fields

You will be transferred to our technology partner, DTN, to complete your enrollment. This will also allow you to manage your account securely.

Enrollment is continuous throughout the year. Please note that February 28 marks the turnover between the previous year’s cover crops and the current year’s cover crops.

Select the appropriate year for “Fall cover crop planting.” and click the “Enroll Now” button.

In the pop-up box, choose the primary state your fields reside in from the dropdown menu.

Click “Search.” This will lead to a table of associated public records. Choose the correct listing for your operation.

Answer the questions on the “Preliminary Assessment” screen.

Once you select a field on the map, a screen will appear on the right side of your window for you to enter in field information. You will need to enter:

- Land name

- Cover crop management system

- Termination method

- Irrigation type

- USDA-organic certification status

- Tillage method

- Cover crop status

- Cash crop

- Cover crop type and acres

- USDA identification numbers (farm number, tract number, and field number).

- If you do not know your identification numbers, they can be uploaded with your verification documentation later. However, you will need to input this information before you can receive payment. If you proceed without entering them, you will be sent an email reminder before payments are processed.

- Click “Add field”

You can add other fields until you have selected all the fields you wish to enroll. You might need to zoom out on the map to view your other fields. (NOTE: This information is submitted to USDA to facilitate your payments.)

If you wish to change information for one of your enrolled fields or need to add USDA identification numbers, click the pencil icon to make any corrections or additions.

- Click “Save for Later” to return to the application or click “Next Step” to continue

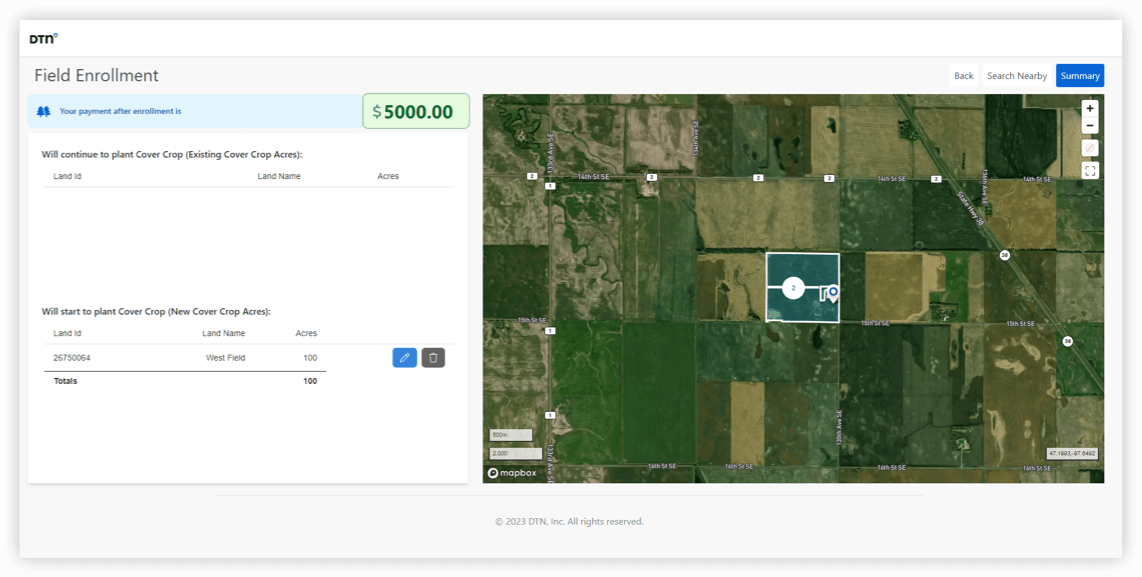

After you have selected all your fields and acreage for cover crop planting and clicked the “Next Step” button, you will see a screen that gives details of costs and how much you will receive for enrolling in the program based on the acreage.

- You will also need to agree to the Terms and Conditions on the left side screen, sign with a digital signature, and verify with your SSN or EIN.

- NOTE: Any changes made to the application will have to be reaffirmed in this step.

- Once you select “Submit Application,” you will receive a confirmation email.

If you are unable to complete the application, you can choose “Save for Later” to complete enrollment at a more convenient time.

About this Program

This program is available for three years. Crop fields in a corn and/or soybean rotation will be eligible for transition incentives totaling $50 per new acre of cover crops across three years. Signing incentives of $2 per acre are available for existing cover crops. The program requires participation in measurement, reporting and verification to demonstrate progress toward the goal of expanding cover crop adoption to 30 million acres by 2030.

Frequently Asked Questions

The Farmers for Soil Health (FSH) collaboration, with the National Fish and Wildlife Foundation (NFWF) serving as their designated administrative lead, was selected by USDA to receive a $95 million Climate Smart Commodities award. The project includes four strategies:

- FSH will support and expand technical assistance, enrollment and education programs in targeted states through grants associated with this project.

- FSH will establish a new financial assistance program to incentivize cover crop adoption on over 1.3 million acres of crop fields in corn and soybean production. Participating farmers will plant cover crops for three years and receive Transition Incentive Payments (TIPs) totaling $50 per new acre of cover crops planted.

- Year 1 = $25/acre

- Year 2 = $15/acre

- Year 3 = $10/acre

Signing Incentive Payments (SIPs) of $2 per acre are available for up to 600,000 acres of existing cover crops. NFWF will make the annual financial payments to participating farmers with funding separate from the grant.

- FSH will create and launch an enrollment platform, as described above, as well as a nationwide cover crop Measurement, Reporting and Verification (MRV) system.

- FSH will create a public marketplace platform to connect farmers to buyers of climate-smart commodities and opportunities for premiums and incentives.

Crop fields in a corn and/or soybean rotation are eligible to receive Transition Incentive Payments (TIPs) or Signing Incentive Payments (SIPs) in exchange for planting cover crops and participating in the Farmers for Soil Health enrollment and Measurement, Reporting and Verification (MRV) system. SIPs are limited to crop fields where cover crops are already planted annually. TIP enrollment is open to any corn or soybean fields where cover crops are not currently part of an annual rotation. TIP enrollment is open both to farmers with some cover crops looking to expand and to farmers with no cover crops looking to start. The same farmer may receive SIPs for fields with existing cover crops and TIPs for fields new to cover crops.

The following 20 states are eligible to participate in the Farmers for Soil Health Climate Smart Commodities Partnership: Delaware, Illinois, Indiana, Iowa, Kansas, Kentucky, Maryland, Michigan, Minnesota, Missouri, Nebraska, New York, North Carolina, North Dakota, Ohio, Pennsylvania, South Dakota, Tennessee, Virginia, and Wisconsin.

Farmers for Soil Health (FSH) Transition Incentive Payments (TIPs) can be stacked with other Climate Smart Commodities project payments if they are paying for something other than the cover crop practice. FSH TIPs cannot be stacked with USDA NRCS cover crop cost share payments, such as through the Environmental Quality Incentives Program, or EQIP. FSH TIPs can be stacked with other state or private (non-federal) incentives and cost share opportunities.

The National Fish and Wildlife Foundation (NFWF) will issue Transition Incentive Payments (TIPs) or Signing Incentive Payments (SIPs) to participating farmers. These payments will be made from a separate funding pool. TIP participants will receive $50 per acre total over a three-year contract.

- Year 1 = $25/acre

- Year 2 = $15/acre

- Year 3 = $10/acre

We expect payments will be sent out in spring following planting of a cover crop the previous fall. Cover crop planting will be verified by remote sensing through the Farmers for Soil Health Measurement, Reporting, and Verification (MRV) platform and self-certified by the farmer.

Opportunities within the sustainability marketplace will be paid through the DTN platform.

Participating farmers will need to self-certify the following information:

- Their USDA farm, tract, and field numbers. Farmers without farm, tract, and field numbers can obtain them from their local USDA Farm Service Agency field office.

- For Transition Incentive Payments (TIPs), farmers must verify that they are not concurrently receiving USDA NRCS cover crop payments on the same acres.

- Compliance with USDA Highly Erodible Land and Wetland Conservation requirements. Farmers will need an AD-1026 form on file with their local USDA office.

- They will plant cover crop acres enrolled in TIP according to state NRCS conservation practice standards for practice code 340 (cover crop), or an alternate practice standard pre-approved by USDA and Farmers for Soil Health partners.

Farmers will be required to use our enrollment platform’s map tool to identify the enrolled fields and confirm or edit field boundaries and acreage. They will also need to provide information necessary for payments, such as a W-9 tax form.

The DTN Marketplace is built on a foundation of transparency. A key requirement is that farmers are in control of their data and can decide who may access it and how it can be used. For every offer, either Farmers for Soil Health or others from the private sector will transparently inform the farmer if their data will be shared or used by or with any third party.

For the FSH Climate-Smart Commodities Partnership, any data a farmer provides will be used to ensure compliance with USDA and Farmers for Soil Health program requirements and for the measurement of carbon and other environmental impacts in the aggregate. This data will be anonymized and reported publicly only in aggregate. Specific farmer data associated with named individuals, addresses, collection points, etc. will not be sold, shared or distributed to any third parties without express permission from the farmer. Any third-party data sharing will be subject to a licensing agreement for disclosure to that party only.

No. There is no acreage limit for new cover crop fields that can be enrolled for Transition Incentive Payments (TIPs). Additionally, there is no acreage limit for existing cover crop fields can be enrolled for Signing Incentive Payments (SIPs).